“Voice of what?”

I remember the first time I heard “voice-of-customer research” dropped in a convo at work.

This was long before I was a copywriter.

And to be honest I thought, “That’s some awkward syntax right there. Why not Customer Voice Research?”

Little did I know…

This very type of research would come to dominate my days and nights.

Because voice-of-customer copywriting research is the foundation for writing copy that converts.

But don’t just take it from me.

The world’s most respected conversion copywriters say they don’t “write copy”. They swipe “sticky” copy from voice-of-customer research.

Cases in point: This post by Jennifer Havice on CXL. And a tutorial by Joanna Wiebe (who may have invented the process).

Does swiping sound easier than sweating over a draft?

Well, there’s a little more to it than grabbing phrases from your customers to perk up your copy.

Voice-of-customer copywriting research is more like mind-melding with your ideal audience

It’s an immersion into their psychology.

The purpose of which is to grok just where they are at – vis a vis the thing you’re selling.

And to discover what messages your reader needs to move towards the next “yes“.

Because getting to the next yes is the goal of conversion copywriting.

To that end…

In this post, I’ll show you how we enter the conversations happening right now in your prospects’ minds.

Through research. Specifically, you’ll discover:

- What’s involved in voice-of-customer copy research

- What type of research you need

- What to look for in your research

- Essential survey and interview tips

- Essential comment mining tips

- Basics of competitor audits

- How much research is enough

- Writing copy research reports

But in case you’re thinking, “Hmmm, research. Hmmm, very long post. Can’t I just use good old direct response sales copy techniques?”

You COULD.

But without voice-of-customer research, you’ll simply be guessing at what copy will stick.

With the risk that instead of sticking, your copywriting slips with nary a splash past the consciousness of your readers.

Which is a real likelihood even if your copy is tricked out with the slickest techniques of off-the-shelf persuasion.

To the point:

We do this work because copywriting that converts is relevant, compelling and persuasive to the very specific humans you need to persuade.

You’ve got to KNOW them deeply.

But if you’re curious…

If you’re persistent…

And if you’d rather spend time in other people’s minds, you’re going to love it.

Down with that? Let’s get started.

What’s involved in voice-of-customer copywriting research?

Voice-of-customer research is, well, just what it sounds like.

You’re looking for what customers say *in their own words* about the thing you offer.

Ideally, you’ll run at least one of these types of research:

- Surveys

- Interviews

- Comment or review mining (which I’ll explain below)

All of which is time-consuming for copywriters and the businesses that hire us. I often spend 40 hours or more before writing a single line of copy for a client.

But have no doubt. It’s worth the investment of time.

Because using voice-of-customer in your copy makes you look magical.

Like a mind reader.

Which you will be.

What Type of Voice-of-Customer Copywriting Research Do You Need?

The gold standard is to pull from multiple sources: surveys, interviews and ethically eavesdropping online (aka “comment mining”).

This is called research “triangulation“. Say it like Adam Sandler on SNL.

But you can’t always geek out to your fullest on every copy project.

- Some clients simply don’t have the budget for a long research phase.

- Others don’t have time.

- And rarely, you won’t yet have customers to survey or interview. (More on how to overcome this below.)

Here’s how to figure out which voice-of-customer research is right for your project:

If things are tight:

Say, you have VERY limited time or budget for copywriting research.

In that case, skip the surveys and interviews and just do comment mining.

By “limited,” I mean you have ten hours or fewer budgeted for research before copywriting even starts. Comment mining will take at least that long.

If you’ve got some leeway:

You should add a survey to the comment mining. Maybe more than one survey. We’ll discuss this below.

Setting up, running and analyzing survey results can take at least another ten hours. (Fewer if you use my examples, shared below.)

If your team is invested in research:

Interviews are gold. If you can swing it, run them.

Naturally, interviews take significant time to organize, conduct and analyze. Budget for at least an hour per interview, on top of any surveys and comment mining.

Competitor copy audits are related but…

Because your competitors are not your customers, am I right?

But we still care what they’re saying, especially in their copy.

So, it’s more like, voice-of-competitor research.

Since we do competitor copy audits in parallel with customer research, I’ll quickly touch on this topic below.

What to Look for in Voice-of-Customer Copy Research

SEO and conversion copywriter Chima Mmeje covered my answer in her post on writing service pages. Here’s what I told her:

“Conversion copy research starts with this question:

What do we need to know about the reader to move them to the next most valuable “yes”?

Whether that next “yes” is to:

- Make a purchase

- Sign a petition

- Donate to charity or

- Opt into a newsletter

You’re always looking for the next “yes”.

For simplicity, let’s call the thing you need them to say “yes” to the “solution” here. You’re selling a solution and your copy research needs to tell the before – during – after story of life with this solution.

So, what is their life like before discovering the solution?

Why isn’t that quite perfect?

What’s their life like with this solution?

Ideally, you already have users of the solution you’re selling. Analyze their feedback and reviews. Survey and/or interview those users until you can paint a vivid picture of that before – during – after story with the copy.

Research what the competitors’ customers are saying about their before, during, and after stories too.

If your copy tells the exact same story, the only way you can win is by blowing the competition out of the water with proof and believability.

You’re going to need those anyway, but if you can also differentiate, you have the golden formula.

Questions I look to answer in my research include:

- What is the ideal buyer’s stage of awareness?

- What do they think about the problem we solve?

- What alternative solutions are they using/have they used/are they considering?

- What beliefs or past experiences are holding them back?

- What beliefs or past experiences make them more likely to say yes to us?

- What new thing do they need to believe to take the next step?

- What proofs are they likely to find persuasive?

- If they say yes, what’s going to change in their lives?

- Despite all this, what objections might they have?

After I wrote a course sales page for Copyhackers, I explained step-by-step in a Tutorial Tuesday webcast how I used conversion copy research to write the page.”

Essential Tips for Running Voice-of-Customer Surveys and Interviews

Now you know what you need to find out. Don’t guess at the answers. Ask.

If you can run surveys and interviews, here’s how to proceed.

1. Decide who to ask what questions

First, know this: “the customer” doesn’t exist. At least, not as a static avatar.

Your customer is like the friend whose psychology you hear shift, over time, like this:

Week one:

“I’m feeling sluggish and my skin is blah. Ugh, it’s the worst.“

Week two:

“I’ve heard colonics are so purifying.“

Week three:

“Ok. Never doing THAT again.”

Week four:

“But Keto…”

Week five:

“Can you smell ketones on me?”

Week six:

“I almost died of an electrolyte imbalance.”

Week seven:

“It’s all about fiber. I’m vegan.”

Week eight:

“Have you noticed, I’m glowing. No, not pregnant. Vegan.”

Week nine:

“I’m running marathons now. Zero pain. Plant powered.”

Week ten:

“Can I make a recommendation for you?”

…

In other words, your customer is evolving.

Specifically, their beliefs, sophistication and preferences about what you sell change with experience.

They’re on a ‘customer journey’. And you need to think of customers at different stages as different audiences.

Because what you ask them in research and what you pitch them in copy will vary based on their stage.

Let’s break down your customer audiences

There are…

- Ideal prospects who haven’t heard of you (let’s call them cold audiences)

- Prospects who are curious

- Brand, spanking new customers

- Loyal customers

- Former customers (of whom we otherwise do not to speak)

It’s trickier to reach those who haven’t heard of you.

But you can either buy their survey responses through something like Survey Monkey, or stalk them in forums and groups where your ideal buyers hang out.

Each of these customer or audience groups can give you different insights.

- Loyal customers know why your solution is better than the rest.

- New customers can recall the moment they chose you/what triggered them to buy… unless they’re goldfish. Don’t ask goldfish.

- Prospects can tell you why they’re still on the fence about choosing your solution.

- Cold audiences can help you understand how they see the problem you solve – or if they even see the problem at all.

- Former customers can tell you why they decided against your solution… in a fit of temporary recklessness, of course.

Design a research plan that taps into each of these audiences and you’re armed to write copy for all stages of awareness.

Note that you will need to ask different audiences different questions.

2. Write the questions you’ll ask in surveys and/or interviews

In general, your questions should:

- Confirm who the respondents are and their familiarity with your solution or category

- Ask about the problems they face(d) without your solution and how these issues affect(ed) their lives

- Find out what they were doing before using your solution

- If they’re not yet using your solution, find out what else they’re using or considering, if anything

- Ask what brought them to seek out or consider your solution*

- Find out what made them choose your solution*

- Explore their experience with your solution, including the benefits, features and outcomes they love*

- If they stopped using your solution, explore what was missing* (hint: sometimes it’s just information, which you, dear copywriter, can deliver)

Notice the pattern?

You’re looking to get that before-during-after story through surveying and interviewing.

Questions like these work for any industry.

* However, DO adapt your survey and interview questions to the audience

If you’re asking a cold audience, questions 5-8 clearly don’t make sense.

To adjust these questions for interviews, simply adapt your script to match the audience.

For surveys, you can create new versions or use logic jumps to make the path through the survey different for different audiences.

Not sure your audience will tolerate so many questions?

In Copy School, Joanna Wiebe (the original conversion copywriter) teaches an essential surveying method.

This method pares down your question to just one per lead or customer — and you only ask this survey question on your thank you page right after the visitor has opted-in or purchased… in that highly “seducible moment”.

You’ll use one of these two questions adapted to your scenario:

1. What was going on in your life that brought you to x today?” (Where x is the thing they said yes to.)

2. Now that you’ve x, how are you planning to use it?” Or, “What results are you hoping to achieve?”

Joanna suggests asking one question for ~2 weeks and then asking the next question for another ~2 weeks.

The first question reveals the “before state,” and the latter question reveals their “after state” or “dream state”. Understanding these, in your customers’ own words, helps you write more persuasive copy.

Other quick tips:

- Keep your questions largely open-ended, like the ones in my template, below

- Don’t ask your respondents to speculate, guess or say what they might do in any scenario

- If you’re asking via a survey, use open text fields so you can get verbatim voice-of-customer feedback

- Don’t ask questions you don’t need to ask. Be ruthless in distilling your list of questions down to the essentials

3. Next, set up your survey and interview tools

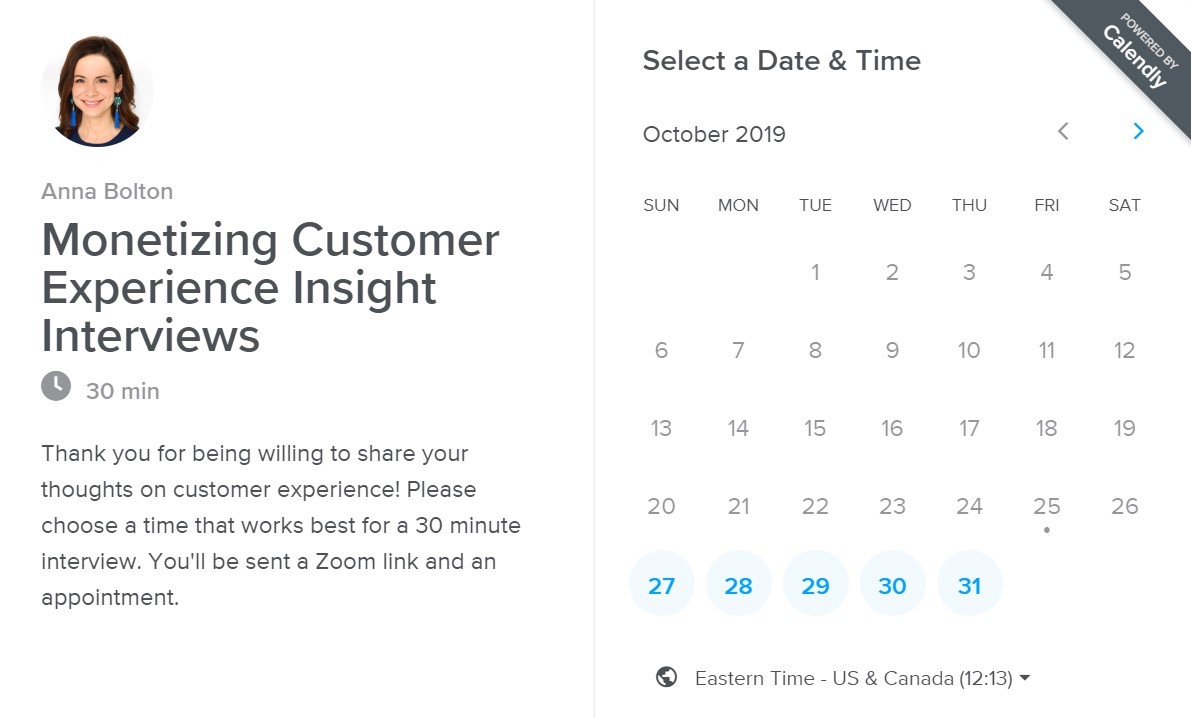

For interviews, you’ll need:

- A calendar booking tool, like Calendly

- A call hosting tool with recording features (the rest of the free world and I use Zoom)

- A transcription tool or service, like Rev.com

More on how you’ll use these below.

There are plenty o’ survey tools out there. I’m partial to Typeform.

To get a quick Typeform tutorial, you can see my survey design and question sequence in this video.

Heads up. You’ll also need a tool to organize the data you get from surveys and interviews.

Generally, I use a Google spreadsheet like the one available in the Copyhackers 10x Web Copy course.

I’ve also used Aurelius to work with the data more flexibly. If you’re collecting voice-of-customer for one company or industry over time, Aurelius is like a smart database that grows with your research.

Instead of rigid columns and rows, with Aurelius you get TAGS!! Tags for the win!!

But… if it’s a one-off project, a spreadsheet works.

Have all of this ready and be familiar with the tools before you start inviting respondents.

4. Get survey and interview respondents

This part isn’t conversion copywriting science.

It’s just smart, dogged promotion of your survey and interview invitations.

Most likely, you’ll do this by email to your subscriber or customer list.

You can also buy survey responses, as mentioned, or you can post the invitation on social media – with caution.

If you’re blasting invitations to unknown audiences, some respondents won’t be your ideal customers.

Some could even be your competitors.

But the real risk is not getting enough responses. You’ll invariably need to nudge your audience to respond.

Here’s how I get more survey responses:

- Include an incentive related to the product or service we’re selling, so those interested in the gift are also truly interested in what you’re selling

- Tell people why you need the responses. Giving a rationale when you ask a favor is a proven persuasion technique

- Deliver an excellent user experience (pssst – just Typeform)

I like to run the surveys first and include a final question:

“Would you be ok if we reached out to get more details on your responses? If so, please leave your best contact information here.”

That way you can pre-screen interview invitees and avoid booking calls with people who don’t have a lot to say about your solution.

Those people exist! We think ill of them, but there they are.

Other ways to get more interviews confirmed are to:

- Get the person with the relationship to ask. If the CEO knows the customers personally, they should send an intro to connect you, the interviewer, with the interviewees

- Use your calendar booking tool to let the interviewees book with a click and get automated reminders, which minimize no-shows

- Again, use relevant incentives – or just give a rationale for the ask

I’ve also used what I think of as a Trojan Horse method for voice-of-customer surveying and interviewing.

Here are two examples:

- Offer to feature ideal prospects in a blog post and interview them

- Set up an application form for a program or service and include some of the questions above

That blog post research is actually voice-of-customer research. It also just happens to serve the purposes of creating relationships and content.

And that application form is also your voice-of-customer copywriting research. It also just happens to be a great pre-qualifying tool.

These Trojan Horse methods might not pass your university’s ethics review…

But if you’re legitimately doing what you say with the interviews or surveys/application forms, there is no reason you can’t also use the insights for copywriting.

Am I going to copywriter hell? Maybe. But the real question is, will I see you there?

5. Interview like a pro

If you’ve never run interviews before, you’ll want a script to stay on track.

After ~10 years of interviewing and because the social anxiety center of my brain is missing, interviews don’t phase me.

But I still use a script for interviews.

And wear pants.

Here are other key voice-of-customer interview pointers:

Open with the obligatory Zoom chat.

Chances are, they’re currently experiencing a local or global apocalypse. Be aware of the specifics because it’s good for small talk.

Use intro notes.

Grab these from the doc I linked to, above, and use them so you don’t pounce with your questions like an interviewing robot.

Avoid leading or steering the respondent.

Don’t prompt them with suggestions or examples. Don’t give your own response to questions or suggest an answer. Stay neutral.

Just ask the question and wait! Get comfy with silence.

Listen for clarity.

If you think you don’t understand, paraphrase and ask if you’re right. I.e. “So what I’m hearing you say is X, Y, and Z. Did I get that right?”

Probe for deeper answers.

Try, “And how did that go?” or the classic, “Can you tell me more about that?“

If the convo veers off-topic, try saying, “Can I just interject for a second? You said something that jumped out at me and I want to circle back to understand what you meant.”

This interrupting technique is almost physically impossible for me, as a Canadian. But it works.

Manage time.

Look through your list and skip questions they may have already answered. Do a time check with the interviewee if you’re at risk of going over.

Finally, express gratitude.

It’s no small thing to be interviewed. But people DO love being asked for their thoughts and you may be the one person who really listens to them all day.

That’s special.

In short, don’t let interviews worry you. It’s mostly following the script – and with the link above, now you have one.

5. Capture and organize your survey and interview data

Let’s start with organizing survey responses.

If you’re using a great survey tool, like Typeform, you are golden.

With Typeform, you can easily export the responses into a spreadsheet, organize and theme them. I like to set mine up something like this:

These categories are not written in stone, but give you an idea of how to roll with this.

Watch this video to see how I themed survey feedback for a Copyhackers project.

Sidebar on quantitative data

Quantitative data isn’t what we call “voice-of-customer”, but sometimes you need it to evaluate the weight of responses and slice the data.

The shortcut to telling the difference is this: Quantitative can be counted. Qualitative can’t.

So, multiple-choice and scaled responses are quantitative. Open-field text is not.

Here are examples of where quantitative comes in handy:

If 40% of respondents said they aren’t actually using your solution, you can separate those from the respondents who actively use and love it.

And if 90% say GIFS are what keep them using your solution, you know that feature’s a winner.

When you’re theming your quantitative data, you can also count the volume of comments that fall under a theme, so you know which themes are most important. (Learn how in Copyhackers 10x Web Copy training.)

How do you capture interviews?

The power of technology! Gone are the days of scribbling notes furiously.

Here are the exact steps I take:

- Use Zoom’s recording function to get an mp3 file (with permission from the interviewee to record.)

- Upload that mp3 to Rev.com and get a transcript. I choose the expensive version, for accuracy.

- Cut and paste the transcript into an interview tab on your voice-of-customer spreadsheet under the appropriate headings.

Zoom will also give you a transcript if you have the recording feature.

However, Zoom produces an AI transcript and it’s quite poor.

(Funny aside. An Australian on a call once said to me, “I have to pee! I have to pee!” No kidding. It happened. AI transcribed it as “I have to pay! I have to pay!” Ok, cool, you can pay me.)

In any case, we always have to correct AI transcripts. You can do this inside Zoom if you want to save money on a professional transcript.

If the interviewee can’t do Zoom, I use their preferred video meeting option and turn on my iPhone voice note recorder. This makes me nervous, but it’s a second-best option — and now, with Rev, you can record and order a transcription from one phone app.

Note that you can’t record on an iPhone while also talking on a call. Don’t plan on it:)

6. Theme and swipe from voice-of-customer copywriting research

When you analyze your survey and interview data, you’re looking for two main things:

- Themes that emerge from different types of respondents

- Memorable phrases, or what we call “sticky copy”

On themes:

Themes are just patterns. Look for themes under each of the category headings I’ve included in my spreadsheet – or the categories you prefer.

Why bother with themes?

First, because you can’t possibly absorb all of the data you collect. Theming makes sense of it.

But also, because your copywriting can’t say everything.

Your copy should reflect and influence the ideas, beliefs and feelings of your ideal customers. Not the outliers, but that bullseye, perfect customer.

Grouping your voice-of-customer copywriting research into themes lets you find out what’s most important to that perfect customer.

And it keeps your copy tightly focused.

Here’s a theming example:

You might find that most customers talk about the pain/problem/life before in terms of not having enough time.

And hopefully, your most satisfied customers say you save them time.

If time is a dominant theme, then you know it’s key to highlight in your copy.

It’s like sticky note clustering.

You’re finding out what the clusters are, which clusters are dominant and the relationships between clusters.

You might have sub-themes as well. A word on this.

- Most solutions offer multiple benefits and features. You can bring a handful of these themes into your copy.

- You can also use multiple reasons to believe in your copy based on which proofs emerge as most persuasive to your customers.

- Your Big Idea and One Promise, however, are singular. If you have multiple themes for these, you have to decide which one to use for each. I talk more about these elements of copy in this post.

Luckily, you can figure out what themes are strongest in your voice-of-customer copywriting research. Then, handpick themes for each message.

Quick sidebar: You’ll notice in your research how those at different stages of awareness prioritize different things. Andrew Yedlin touches on how to handle this in his brilliant post on copy length.

7. Find the “stickiest” voice-of-customer in your research

In your survey and interview data, look for those colorful, resonant, bold, memorable phrases.

If they align with the themes, flag them to pull into your actual copywriting.

You might need to massage the verbatim comments to fit the copy, but stay true to the language as much as possible.

Even if it sounds casual. Especially if it sounds casual.

Voice-of-customer language is au naturale.

Unvarnished.

It sounds more authentic because it IS.

And that makes it more potent than marketing speak.

Sticky customer copy is also driven by emotion.

It’s powered by actually experiencing the problem you solve and the relief you deliver. If you find voice-of-customer laden with emotion, that’s a clue it’s sticky.

➡️ Tap that sticky like a sustainable rubber tree.

Credit where it’s due: I learned about sticky copy from Joanna Wiebe of Copyhackers.

Essentials on Review Mining or Comment Mining

As mentioned, if you don’t have time or budget for surveys and interviews, comment mining is your friend.

This is a type of voice-of-customer copywriting research that you “mine” from what people say online…

Just like Snow White packed you off to the Research Mountains with your own little lunch in a stick-sack and you’re hacking away at the rocks of ignorance. 🌄

Otherwise, this mining is known as “ethically eavesdropping”.

Ethical, because those comments were posted for the world to read.

Reviews are a great source because chances are, your ideal customers have reviewed your solution or competitors’ solutions.

If you can’t find either of these (because what you sell is so novel, like silicon staples, perhaps)…

Then look for reviews of alternative solutions.

(Things they bought to serve the same purpose, even if it’s not the same thing. Like regular metal staples.)

But frankly, we’re not just looking at reviews. We’re looking at comments in the wild. Comments relevant to what you’re selling.

Places you can find this type of voice-of-customer include:

- Amazon product reviews

- Google reviews (yours/your clients and competitors’)

- Any e-commerce store reviews

- Facebook reviews

- Reddit threads

- Facebook groups

- LinkedIn groups

- Relevant blog comments

- Slack channels (if you can get an invite)

In some markets, customers are tight-lipped. Like luxury markets.

In those cases, you’re going to have to get creative, as I did in this project.

Once you’ve found those reviews and comments, pore through that gold.

What this poring looks like in real life:

Copying and pasting excerpts into a spreadsheet, theming and swiping sticky copy pretty much interminably.

Cancel your evening plans. And your weekend.

Cool?

But we’re still having fun because research is awesome sauce! It is the awesome-est.

Practical matter:

You’ll also need to tag or organize these based on where they were found, so you understand the context.

Here’s why:

If you copy and paste a competitor review that says,

“This stuff has transformed Fluffy from a total slacker into a lethal, high-performing rodent hunter. The pure bioidentical testosterone formulation is literally saving us thousands on extermination fees!!! Sometimes I eat it myself…“

(That one’s for you, Sarah Sal 😺)

And then if you forget that it’s a competitor review and actually, your client sells calming cat food, you might nail the wrong message.

But seriously.

Your customer’s reviews tell you what they love about you. (It’s mostly love.)

Competitor reviews tell you how to differentiate.

Keep ’em apart.

But now that we’re talking about competitors…

Basics of Competitor Copywriting Audits

I’ll do a deeper dive on these audit in a separate post, but in short:

Auditing your competitor’s copy is breaking down what they say and analyzing the messages. You do this to position your solution as different and better.

Check out what those other guys say about:

- Who they serve

- Their unique value proposition

- What benefits they deliver

- Their unique features

- The outcomes or results they promise

- Why customers should believe them

If one competitor says they’re the fastest and the other says they deliver the best experience, you’d better know that before you write copy.

How much is enough? Or when to declare victory in copywriting research

It is never enough.

Just learn to live with that. There will always be an ache of longing in your soul for more answers.

But honestly, you don’t know “how much” until you dig into the research.

“Enough” is as much as it takes to satisfy your questions.

You should PLAN to do as much research as the schedule and budget allow… and stop when you have a convincing stack of answers to your questions.

Here are a few guidelines on getting as close to certainty as possible:

If you’re running surveys…

You need enough responses to see true patterns.

Patterns that accurately reflect your audience.

To find your ideal survey sample size, see this article from Survey Monkey.

If you’re running interviews…

“Seven” is bandied about as the minimum viable number of interviews for voice-of-customer copywriting research.

I searched to find out why we rely on this minimum. And I did not find the answer.

But I did find this, which accurately reflects my experience:

“Research hits a saturation point when incremental interviews don’t introduce new information. Since every new insight is important, you want to get reasonably close to a complete understanding of your domain.

So, interview until you don’t learn much from new interviews.” – The Right Number of User Interviews, by Mitchell Seaman

Saturation is the perfect term.

You’ll notice it when the interviewees’ responses start to sound very familiar.

When you do comment mining…

Again, notice saturation.

I am that miner who believes gold is always under the next rock. Even when I’m five miles underground.

But eventually, I have to revisit my checklist of places customers might be dishing and persuade myself that, yes, I have scoured the last recesses.

When conducting competitor audits…

Usually, the list of competitors will be clear. Break down each messaging element, then move on to the next.

Sometimes you’ll discover competitors that weren’t on your radar. Usually, your prospects or customers raise these names. Check those guys out, too.

Writing Voice-of-Customer Copywriting Research Reports

When you’ve gone deep in the rabbit holes of research like this…

Using what you learn to write copy is one trick. (See my talk on Tutorial Tuesdays to learn how.)

Another trick is selling your research. No, not on the black market. Selling it to the powers that be.

Anyone else who has a say in the copy MUST buy into your conversion hypothesis. And that rationale must be based on your voice-of-customer copywriting research.

(Ok, that was dogmatic. But also inarguably true.)

I recommend you don’t just show up at the debrief with an eye-blurring spreadsheet and raging research enthusiasm, however.

Although you may have spent 20, 30, 40 hours down there in the burrows and warrens, nose to nose with customers…

Others are seeing the research fresh.

You need to step back. Take a deep breath. And extract the essentials.

I like to create a summary deck with key findings. In the deck, I have at least one slide for each of the categories above.

Here are the topics in my main research report slides:

- What customers say about the problem we solve

- What else they’ve tried

- What’s worked/hasn’t worked

- Why they decided to try us

- Objections to the sale

- What benefits matter most

- Features they love

- Outcomes they’ve experienced

That deck can link to the spreadsheet with the verbatim research. You can also include exemplary voice-of-customer quotes in the deck.

Key point: When you share your research, elicit questions. Welcome them. Address them on the spot.

Now’s your chance to surface objections – and, in theory, you may get objections to your interpretation of the data.

After all, you could be wrong.

Maybe you’re one of those people who’s sometimes wrong. What’s that like?

Just kidding.

There should be a healthy debate when interpreting voice-of-customer… and there are subsequent steps you can take to validate your insights. Like user testing.

But take all skepticism with your pride intact. Because almost no one does research like this.

The fact that you’re taking voice-of-customer deadly serious means you are miles ahead of the crowd looking for conversion hacks and templated persuasion shortcuts.

And while conversion copy research like this is an ongoing process — by your dedication, you may be serving up insights that revolutionize the biz-ness.

So, go forth and do voice-of-customer copywriting research with confidence.

If you got this far… if you’re sharing this with the team so they embrace research, too…

Then you’re one in a million.

(Catch that hint there? Share, people, share. There are buttons below for that very purpose.)

Need done-for-you copywriting research?

We do that. All of that, in the service of copywriting that converts.

It won’t get me invited to parties (remember those?), but voice-of-customer copywriting research is my not-so-secret passion.

Get in touch for a quote or to ask about our other copywriting services.

If you want to learn for yourself, Copyhackers’ 10x Web Copy includes several excellent modules on collecting, analyzing, and using VoC in web copy. Like all things Copyhackers, it is stellar.